This is to help educate on 1099 forms and what they are. This article is not tax advice.

What is a 1099 Form?

When tax season rolls around, many individuals and businesses find themselves asking, “What is a 1099?” This form is an integral piece of the tax puzzle, used by the IRS to report various types of income outside of wages, salaries, and tips.

Navigating the complexities of tax forms can be a daunting task for both individuals and businesses alike. Among the myriad of forms the IRS requires, the 1099 form stands out as particularly significant due to its wide applicability across various income types beyond traditional wages.

This article delves into the essence of the 1099 form, providing essential insights, types, filing requirements, and practical advice to ensure compliance and optimize your tax situation in 2024.

Introduction to 1099 Forms

At its core, a 1099 form is a document used by the IRS to report income other than salaries, wages, and tips. It’s an indispensable tool for tax reporting, capturing income from freelance work, investments, and other sources. Understanding the 1099 form is paramount for anyone receiving non-employee income, as it directly impacts tax obligations and financial planning.

Exploring the Different Types of 1099 Forms

The IRS categorizes income through various 1099 forms, each tailored to specific income types. Key varieties include:

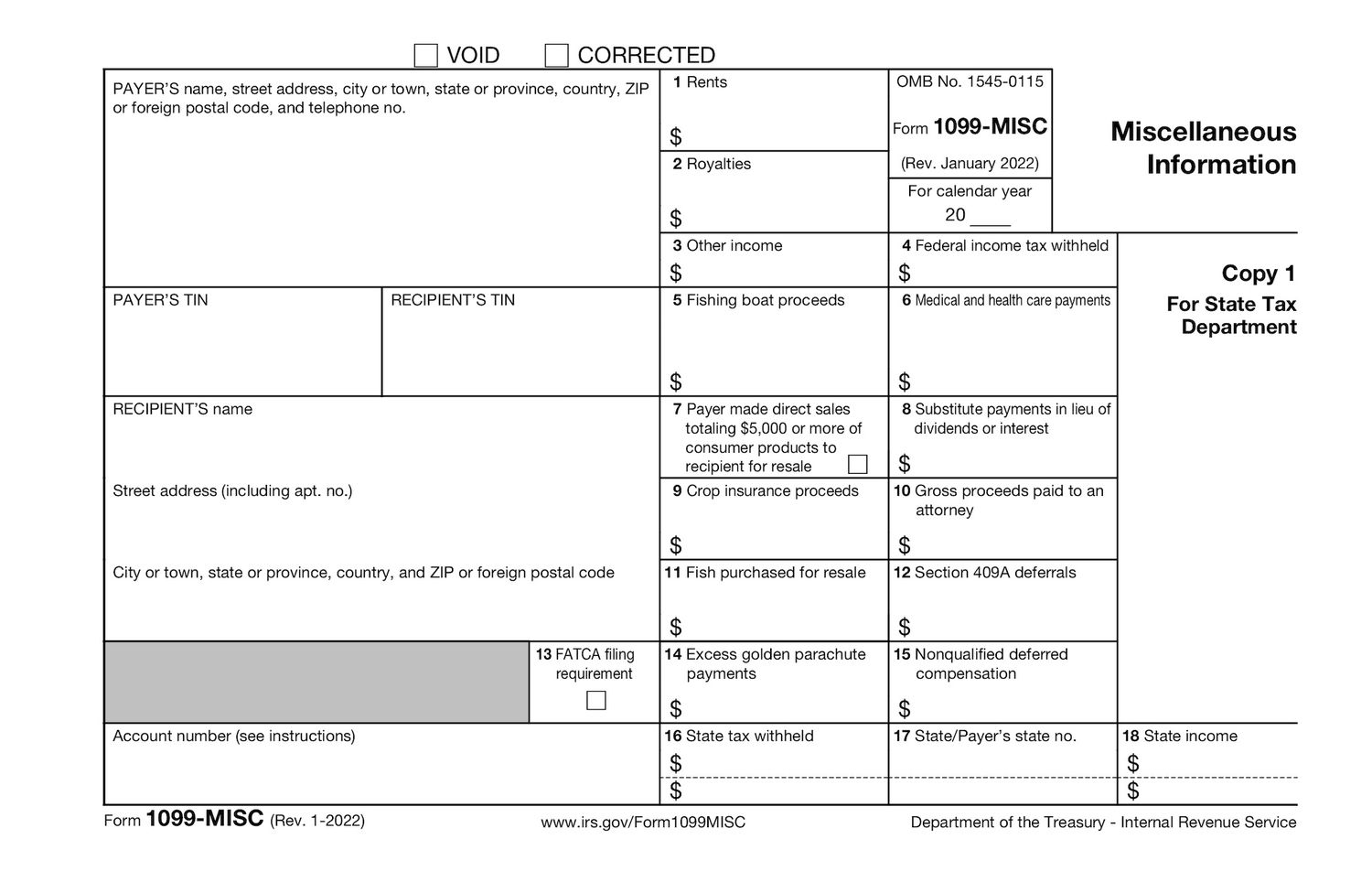

- 1099-MISC: For miscellaneous income, such as payments to independent contractors.

- 1099-INT: For interest income from savings accounts or investments.

- 1099-DIV: For dividends and distributions from investments.

- 1099-R: For distributions from pensions, annuities, retirement plans, or profit-sharing programs.

- 1099-B: For broker-handled transactions, including the sale of stocks, bonds, and mutual funds.

Each form serves a unique purpose, ensuring that all forms of income are accurately reported to the IRS.

Understanding 1099-MISC for Freelancers and Contractors

Freelancers and independent contractors are intimately familiar with the 1099-MISC form, which reports income from services rendered to a business. Navigating the 1099-MISC is crucial for the self-employed, as it affects tax liabilities and potential deductions.

The Importance of Accurate Filing

Filing 1099 forms accurately is crucial to avoid penalties and audits. This involves not only reporting income correctly but also understanding the deadlines for submission. For most 1099 forms, the deadline for sending copies to recipients and the IRS typically falls at the end of January following the tax year.

Electronic Filing: A Streamlined Approach

The IRS encourages electronic filing of 1099 forms through its FIRE system, offering a streamlined, efficient process. Electronic filing simplifies submission, reduces errors, and ensures faster processing, benefiting both the filer and the IRS.

Common Pitfalls to Avoid

Mistakes in filing 1099 forms can lead to penalties and complicate your tax situation. Common errors include incorrect income reporting, missing deadlines, and failing to issue a form when required. Awareness and diligence are key to avoiding these pitfalls.

Preparing for IRS Audits

While the prospect of an IRS audit can be intimidating, proper preparation and accurate 1099 filing significantly reduce the risk. Maintaining thorough records and understanding the information reported on your 1099 forms are essential steps in audit preparation.

Looking Ahead: Anticipating Changes

Tax laws and regulations are subject to change, and staying informed about potential updates to 1099 filing requirements is crucial. Adapting to new rules can ensure compliance and minimize tax liabilities.

Conclusion: Navigating 1099 Forms with Confidence

Understanding and correctly managing 1099 forms is essential for accurate tax reporting and compliance. By familiarizing yourself with the different types of 1099 forms, adhering to filing requirements, and avoiding common mistakes, you can navigate your tax obligations with confidence. As we move into 2024, keep these insights in mind to optimize your tax situation and ensure a smooth filing process.

FAQs:

- Who needs to file a 1099 form? Individuals and businesses must file a 1099 form when they make certain types of payments, including non-employee compensation, interest, dividends, and other specified income types.

- What is the deadline for filing 1099 forms? The deadline for filing most 1099 forms with the IRS and providing copies to recipients is January 31st of the year following the tax year in question.

- Can I file 1099 forms electronically? Yes, the IRS encourages electronic filing of 1099 forms through its FIRE system, which is efficient and reduces the likelihood of errors.

- What happens if I make a mistake on a 1099 form? If you discover an error on a filed 1099 form, you should correct it as soon as possible to avoid penalties and potential audits.

- Are there penalties for not filing a 1099 form? Yes, failing to file a required 1099 form can result in penalties from the IRS, including fines based on how late the form is filed.

- How do I know which 1099 form to use? The type of 1099 form you use depends on the nature of the income being reported. Refer to IRS guidelines or consult a tax professional to determine the appropriate form.